NFT projects during the bear market: What'll it take for NFT projects to succeed?

Bear markets are the Afghanistan of NFTs. (It's where they go to die.) We look at NFT bull signals and my thoughts.

The jpeg markets are quieter than they’ve ever been. Crypto Twitter is dead and boring rn. On the weekly ordinals segment on “The Down Bad Show”, when they asked for any bullish news, I had none. (I wish I had something positive to say, but I can’t just make shit up 😂)

We’re down bad. Really bad 📉

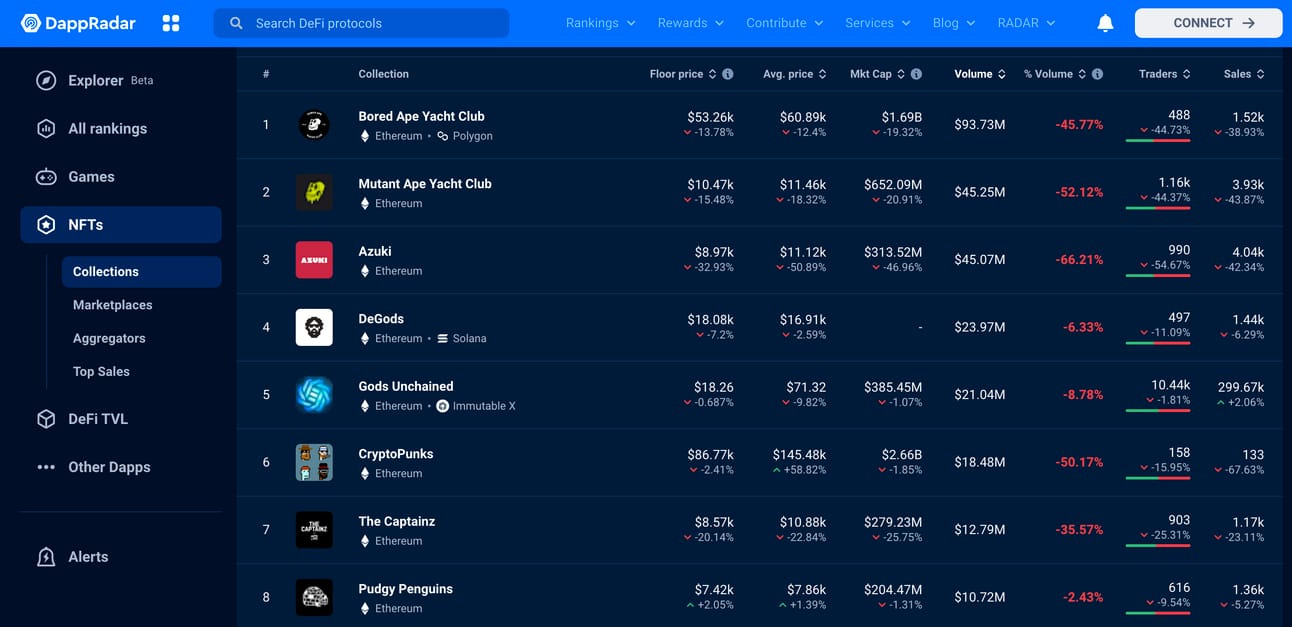

Top NFT Collection metrics based on the last 30 days

Floor prices are trending downward across the board. Projects minting out have become a rarity, not the standard. So what’ll it take for a project to launch successfully and beat the odds against these negative market conditions?

A quick caveat before we begin: The points I discuss when considering an NFT project are far from an exhaustive list. They’re simply points I find interesting, and I have thoughts around them that I’d like to share.

Let’s go 🤙

What’s an NFT project anyway?

Is an NFT project… a company? Is it an art project? What is it, even? I’m not going to rehash all this here. We’re all familiar w/ the arguments. Let’s just define an NFT project as an amalgam of a multitude of borrowed factors. To me, it resembles a startup—w/ jpegs, where the jpegs are a representation of a shareholder’s holding/s.

In the long run, say 2 to 3 years, 90% of all startups fail. (I was surprised that this figure is only 90%, since 95% or more of businesses fail within the same time period. Maybe this is b/c ppl who launch startups aren’t total noobs, like many new business owners are.)

… which brings me to my next point: Starting an NFT project is easier than launching a business irl. With NFTs, you don’t have to deal w/ any bureaucratic red tape. Just grab an idea, link up w/ the right people, and you can launch your very own NFT project in as little as a few days.

So, w/ an even lower barrier to entry, the failure rate of NFT projects should be somewhere upwards of 95%. But again, this depends on how you define “success”, and in turn, “failure”.

Cets: A project that once had great potential

Let’s say that projects that haven’t been doing shit for a while can be called failures, like Cets. (Not sorry.) Let’s give some of the projects that fall into this category a little leeway, tho. For example, Seals have been fairly quiet, but it wouldn’t be fair to label them a failure.

And yes, even so-called art projects, should they fail to continue to deliver to their holders, I consider failures too; that is, unless they correctly aligned expectations early on (i.e., pre-mint), by stating that the project would conclude once X objective was achieved.

Anyway. Enough ranting; w/ that context in mind, here’s what I consider when buying into an NFT project.

The bull signals of NFT projects

I used to look mainly at founders and teams as an investment signal. Specifically, 3 factors relating to founders:

Are they cult leaders?

Frank DeGods, pre-doxx

Think of strong NFT project leaders. Frank, Wab, and Zk, to name a few. First, note the correlation between their presence/absence and the floor price. (One way to measure impact.) Now let’s look at how they influence community presence.

A leader must have the ability to lead their community. This sounds obvious at first, but when you don’t have a roadmap, you’re going in blind. If a leader has a vision, but they can only share it piecemeal, then they must command the respect of their holders, maintain hope, and be able to sustain their attention for the long haul.

It’s obviously unrealistic to expect project leaders to deliver constantly. There’s uptime, but most time in the space is actually downtime.

So what do we do during downtimes?

When we get bored, or we feel like nothing’s happening, we sell. So the trick is to make people feel like things are always happening in the bg. That’s where Discord comes in.

We can think of Discord as a waiting room of sorts. Games and events happen. Chats are busy. But other than the chats, Discord activities mostly comprise events that are indirectly or semi-directly connected to the project (e.g., other project wl spots, poker and/or other games, Discord AMAs, etc.).

Through all this, cult leaders will have created such a strong following around them that the faith they’ve fostered will help them see it through, regardless of whether a project has an official roadmap. (Many don’t.) So if a project that’s been around for a while doesn’t have a roadmap but has a strong following, that’s bullish af for me 🐂

Can the founder Twitter/X?

Wab.eth, founder of Sappy Seals

Are they able to control the narrative? Do they have a sound understanding of guerrilla marketing principles? Do they get engagement like a mfer?

Most founders suck at Twitter. That’s why they’re always dm’ing and trying to partner w/ different brands, KOLs, and influencers to try to expand their reach, especially pre-mint. (Imagine if a company’s stock price pumped or dumped based on how active their founder is on Twitter.)

Anyway. Say a project mints out. That’s great! So what’s next?

Many founders are invisible on Twitter post-mint. (Hell, most of them are invisible pre-mint 😁.) But neglecting Twitter is like turning your back on the greatest sales pit in the world. Everywhere else, be it YouTube, LinkedIn, Facebook, whatever… that’s the tourist tour. If you’re a degen who’s deep into crypto and jpegs, you’re on Twitter. That’s where the real ones are.

And if a founder’s not talking about their project to the real ones, who tf are they talking to?

Is the founder a critical thinker?

Do they KISS? Do they know how to coordinate effectively?

I’m going to share some constructive criticism w/ one of my favorite founders here: Solport Tom of Taiyo Robotics fame (OG solana project that got derugged).

I was a holder of gen1 and gen2 Taiyo + Pilots (gen3). Tom also owns Solsteads Surreal Estate and Citizens by Solsteads. Yeah, you counted right. That’s 5 projects. Most project owners struggle w/ a single project. How does he have the bandwidth for 5?!

Tom also took the Pilots reveal process and supposedly gamified it into a multistep process. I’m sorry, but if I receive a gift, I don’t want a multistep process to find out what it is. I just want to unwrap, unbox, and enjoy.

That’s it.

Pilots Marketplace

If you want to gamify anything, it’s not the mint experience that needs to be gamified. It’s the experience itself. When I buy into an NFT project, I’m buying into a specific experience promised by that project. And the experience doesn’t stop at mint; it begins there, so there’s absolutely no need to micro-gamify that experience.

Btw, Tom is a legit founder, and he works really hard to serve his holders. These are just some of the signals that forced me to sell. That’s all.

Anyway. These are the main factors I used to consider. (Sometimes, less is more.) But sometimes, more is more, so I’ve since expanded a bit of my thinking here, and I’d like to share several other factors I’ve identified that I believe can act as clear bull signals:

Community

Community is a big one for me. It’s pretty much the only signal I paid attention to when I decided to pick up an OK Bear recently 👌 First, I noticed that their Twitter game had changed considerably, in that holders were rallying heavy at the project’s slightest mention. All right… hinting at a gamified Twitter approach here. Interesting.

I had Warbucks, marketing at OK Bears, on a space, and we talked about community. I felt he truly believed in the power of community. I checked the Discord. Whoa. It was built different, fine-tuned like a German orchestral machine.

Three promising factors I noticed right off the bat in the Discord:

I got a warm welcome from a ton of OK Bears. (Not as many on Twitter tho.)

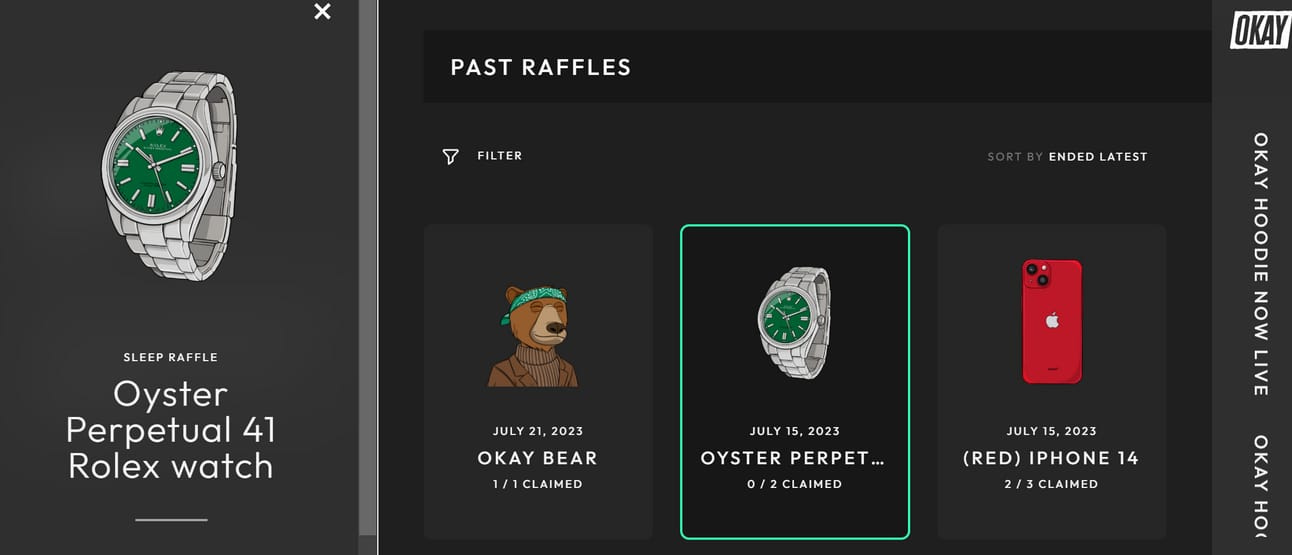

They were running raffles for holders, but w/ irl items. Prizes included iPhone 14’s (newly launched at the time) and Rolexes, delivering tangible value to holders.

They negotiated a discount deal w/ a hotel in Amsterdam for holders. (Awesome.) There’s no shame in securing discounts, even if you’re an elite club. Just think about pleasing holders. Your project successfully negotiated a deal w/ an irl business. That’s a win in any book, not just mine 🤝

A sustainable model

How will the project sustain itself? The answer is specific to every project. There are so many ways to skin a cat. But there are many wrong ways to go about it too. For instance, dilution has recently been found not to be the way.

So what is the way?

It depends, mainly on which chain the project lives on. That’s b/c the chain—its philosophy, and in turn, its specific incentivization scheme’s design as well as its consequent use case—will largely determine how a project can function.

Take Bitcoin. Its design appeals mainly to digital art collectors, numismatists, and so on. That’s b/c, thanks to ordinal theory, we’re able to enumerate individual sats and inscribe immutable digital art directly upon them.

Now take Solana. It appeals to traders and flippers b/c it’s ridiculously fast, and its tx’s are cheap af. DeFi is also making a comeback on Solana, so DeFi-related DAOs w/ jpegs, gaming projects, and casino projects (e.g., Solcasino) should fare well in the next bull.

Now let’s take Ethereum. The first smart-contract chain’s appeal has changed recently, and not for the better. Its positioning and reputation have been tarnished, partially due to the Bitcoin Ordinal boom, but also thanks to Blur’s design driving prices to the bottom. A confusing appeal? As they say in sales, “A confused mind says, ‘No.’”

That’s not to say that a project launching has to fit squarely into one of these categories. It’s just easier to identify those w/ more revenue generation potential if the project’s mission and philosophy are aligned w/ those of its chosen chain. (Ex. An art project would fare better launching on Bitcoin today than it would on any other chain.)

Continued value delivery to holders

Numbers go up? Amazing. But if that’s all we wanted, we would’ve bought coins, not jpegs, right? So what are we buying when we actually buy an NFT?

It’s a hodgepodge of different elements: Other than financial gains, community (a grossly underrated and under-leveraged “utility” of NFTs), friendship, knowledge, etc.

Other than the fun activities organized by projects, like raffles and games, it’s incumbent upon project teams rn to figure out how to go from a value extraction model to a value delivery model. There are so many different ways to do it; each project should pursue revenue generation models that work for them. Those that can’t—or won’t—will get left behind.

Let’s see which projects are left standing once the dust settles, and whether their models will act as foundations for projects that follow.

Realigning expectations

I’m not a believer in wagmi. Sorry. The game just isn’t designed that way. As Taleb points out, like the professions of actors, novelists, etc., the NFT project market is mostly a zero-sum game, where the winner-take-all effect is in play.

I’m not trying to be a party pooper. I’m for positivity too, but not at the expense of truth. (We must always operate from a position of reality, even when our reality is unpleasant.) Truth is, most NFT projects will not make it. I don’t know which ones will, but I do have a thesis, thoughts on which I’ve shared above.

Feel free to act accordingly 🎣