Solana airdrops are coming

My step-by-step farming strategy. Thoughts included. 👨🌾

Solana airdrops are coming

My step-by-step farming strategy. Thoughts included. 👨🌾

Solana airdrops are right around the corner. And there’s still time for you to join in and potentially secure a bag worth five to six figures. I’ll show you what I’m doing to maximize my chances of getting some massive airdrops, which I plan to swap to SOL and add to my bag. Feel free to adjust the strategy outlined here based on your own conditions, like which assets you hold, how much risk you want to take on, etc.

I’ll outline 2 strategies here: low risk and high risk.

Let’s get it 🤙

Things to note before we begin…

The amount you need to get started. Start with anywhere between 10 and 100 sol or more. Use a burner wallet if you want. Protocols aren’t immune from getting hacked. Up to you.

If you want, you can use multiple wallets. (This is what I’m doing.) I’ve applied pretty much the same strategy for each wallet, with adjustments, depending on which assets I already had in each wallet. (We’re going to be lending and borrowing, so the assets you hold might matter.)

I gave you the wide range of between 10 and 100 sol or more because you might want to spread your SOL out a bit here and there, depending on how much of a degen you are, and how much risk you want to take on.

Tracking. Keep track of what we’re doing here. Just write down the steps as you execute the strategy, to prevent things from getting messy and confusing. You want to be sure of where all your assets are locked, because you’re going to have to revert the steps later on to retrieve all your assets.

Feel free to bookmark this article to come back to it later. Near the end, I’ll share a little-known platform that’ll help you keep track of all your Solana assets, and it’s guaranteed to blow your mind 🤯

I’ve also got a YouTube channel now

And I cover this very topic in my most recent video. Watch it to gain additional context. Subscribe if you want more alpha in the future. It’s coming 🤝

My low-risk strategy

My simple low-risk strategy is like so:

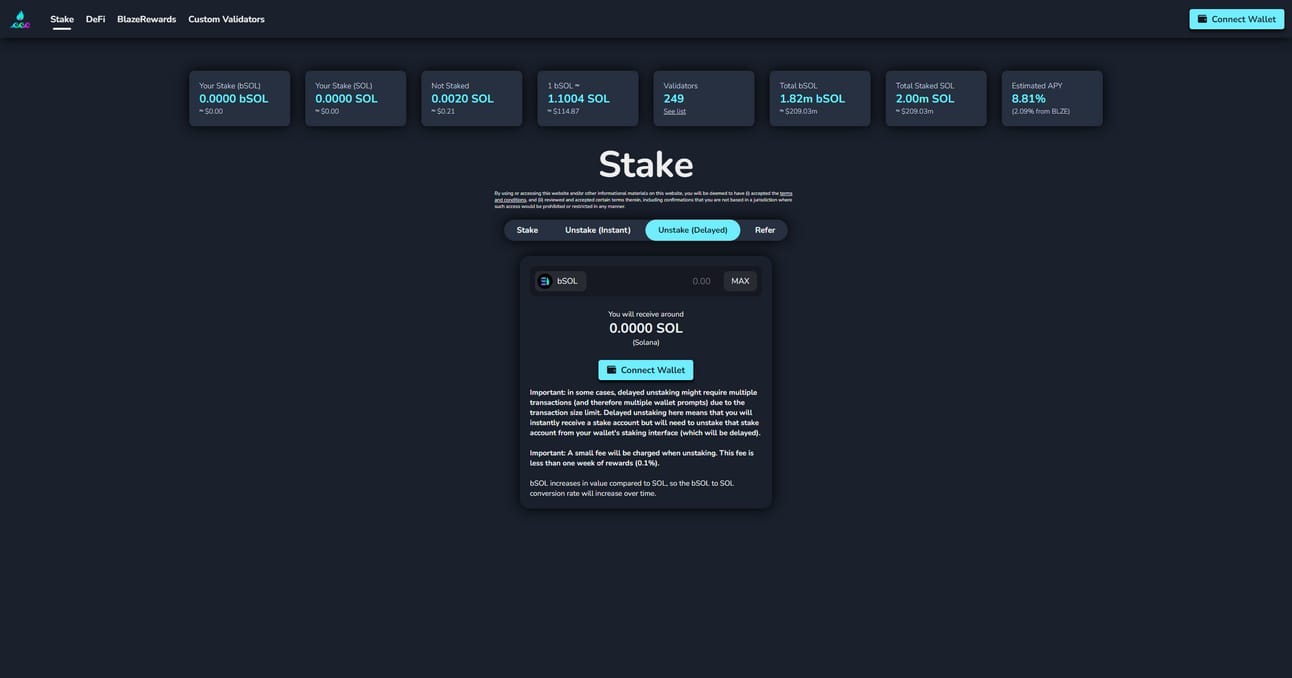

PLATFORM 1: SOLBLAZE

This one’s a no-brainer, and will net you one of the most lucrative airdrops in the coming months. Solblaze is a liquidity staking platform.

SolBlaze

Real quick, what is liquidity staking?

Traditional staking—where we take our assets and stake them on a platform in return for only yield—is vanilla, and it’s not as appealing to us degens. In contrast, liquid staking is a novel approach where we stake our asset (e.g., SOL), and in return, we receive a collateralized version of our asset (e.g., we gib SOL, we get bSOL.)

Doing so allows us to use this freed-up liquidity around the ecosystem, thereby being able to do more with our assets (i.e., make our money work harder for us).

So on Solblaze, stake as much SOL as you want. You’ll get a little less bSOL than SOL, because bSOL is valued slightly higher. Once we get our bSOL, we head over to our next platform.

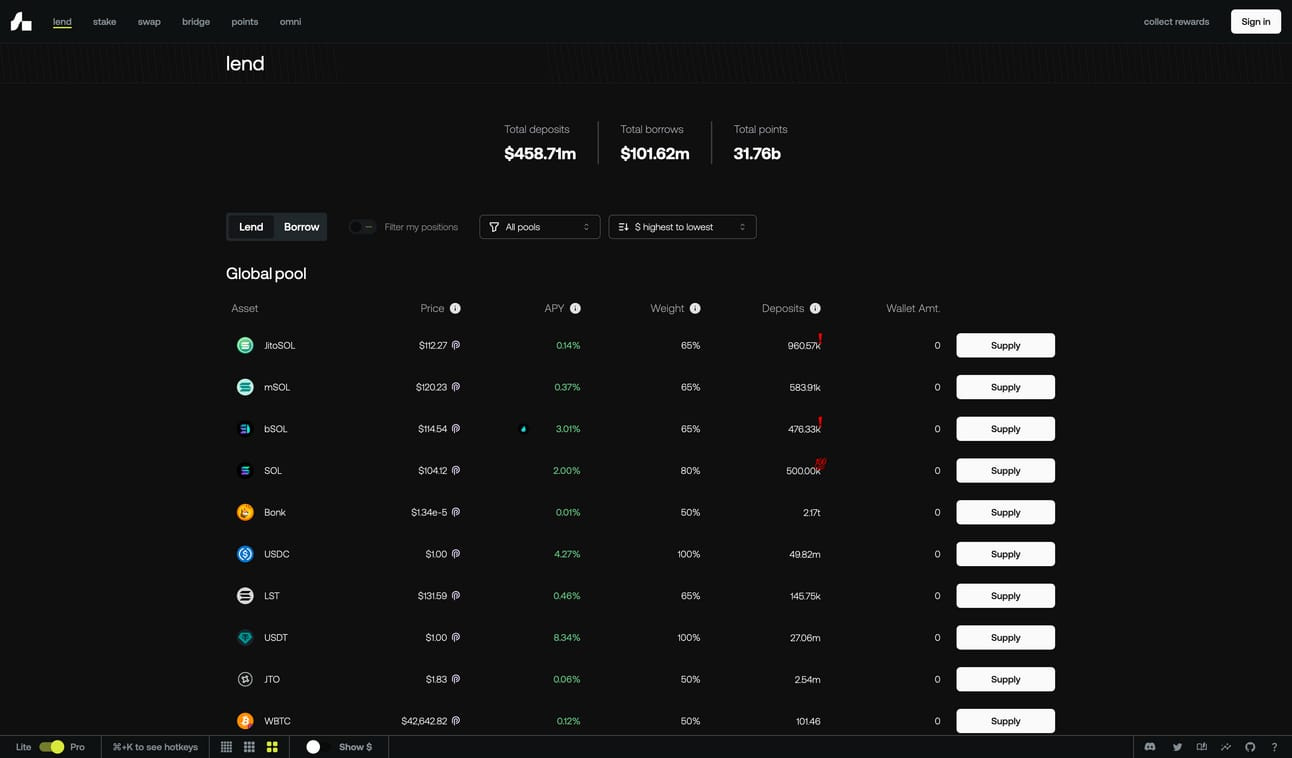

PLATFORM 2: MarginFi

MarginFi

MarginFi is a lending protocol. Here we’re going to click “Supply” (lend), and provide MarginFi with all of our bSOL. Doing so will provide us with 1 point for every $1 we lend daily.

Next, we can use that bSOL and borrow against it! But why would we want to do a thing like that?

Because MarginFi provides 4x the amount of points for borrowing than it does for lending! In other words…

Lending = 1 point per dollar per day

Borrowing = 4 points per dollar per day

So borrow an asset that’s pegged to SOL (i.e., bSOL, jitoSOL, or mSOL), and if none are available, borrow something with a low APY.

Tip: You might want to cross-check with the next platform to make sure that the asset you’re considering borrowing is also in demand on the next platform. (Just check the Max LTV %.) 😎

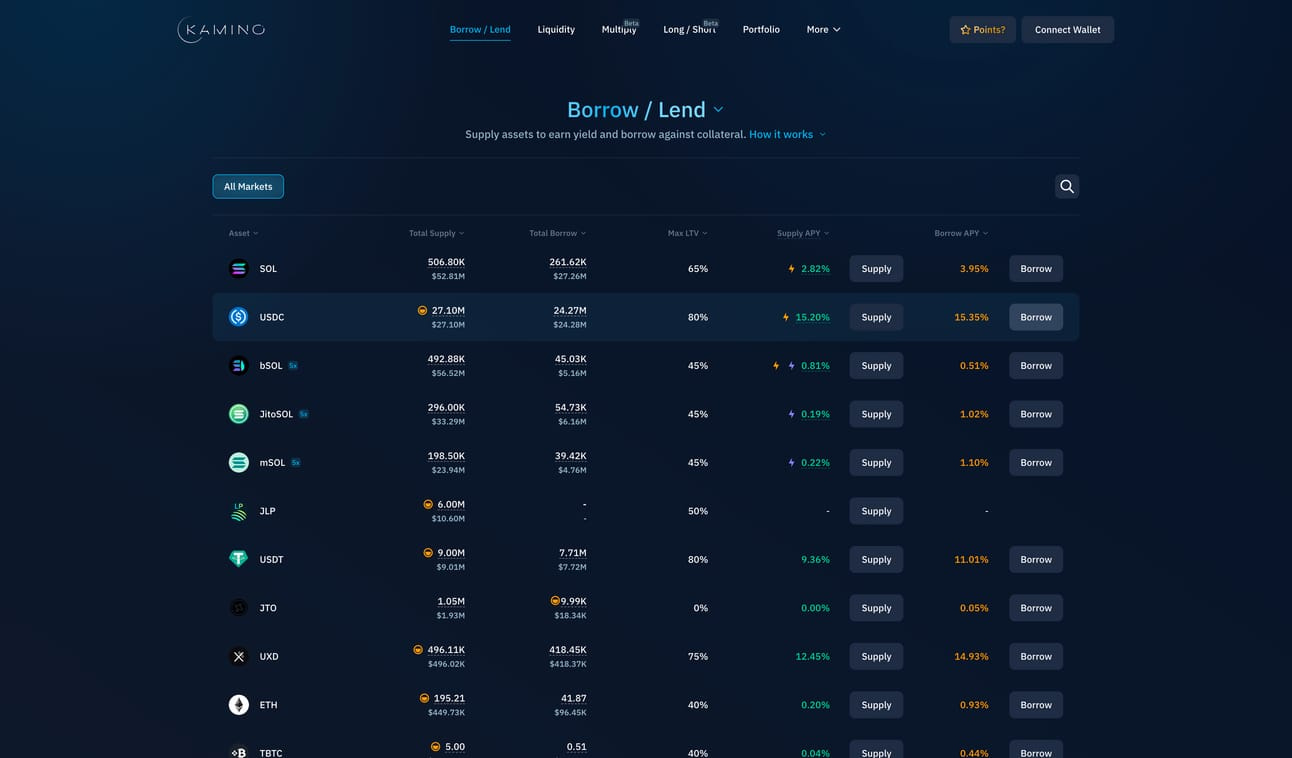

PLATFORM 3: Kamino Finance

Kamino Finance

So let’s say you borrowed mSOL from MarginFi because it offers a decent borrow rate, and Kamino Finance wants some mSOL. Now we head to Kamino. Kamino Finance is also a lending protocol, and is a competitor to MarginFi.

You can lend all your mSOL here by clicking on “Supply” and approving in your wallet. Once you’ve supplied, you can borrow jitoSOL. Keep in mind the differences in APY, but we’re farming for airdrops here, so you can expect to lose a little money in the short term. The bet is on the long term (i.e., the airdrops)!

Do keep an eye on the APY % once in a while, tho, because it can change. As long as your net APY % isn’t too negative, you should be good.

Having followed these steps, you should be farming for airdrops on 3 platforms so far: SolBlaze, MarginFi, and Kamino. Now you can take your jitoSOL, go back to MarginFi and lend it all out if you want to be done. Else, you can check out the higher-risk strategy below.

But first, the risks…

Interested in NFT Airdrops?

Tensor is an NFT marketplace on Solana. Tensor volume blows all the other Solana NFT marketplaces out of the water.

Unfortunately, you stand to reap the most benefits if you hold a Tensorian NFT, from their official NFT collection, but these cost upwards of 85 SOL rn.

Risk of Impermanent Loss in the Low-Risk Strategy

There’s one main risk you need to be aware of, and that’s impermanent loss. That’s when you supply two tokens, and the price of one of them runs, so people end up buying that token, and you end up with more of the other one.

The loss isn’t actually realized until you sell the whole bag, so the “loss” part is actually in the opportunity cost of capital (i.e., where would you have made the most money?)

Example: You add funds into a BONK-SOL pool (50% BONK/50% SOL). BONK price runs. Everyone buys it from the pool. You end up with the SOL bag. (When you inject funds into an LP, you’re usually earning a percentage of the transaction fees by supplying that liquidity.)

In this case, you might have netted a lot more had you simply held onto BONK, instead of providing liquidity and earning from the fees.

The risk here, with the strategy we’re playing, is much lower because we’re playing with coins that are pegged to SOL, so if one coin runs, so does the other one.

That’s not to say that these protocols can’t crash or get hacked, but that’s the risk we’re taking here. Moreover, as mentioned, we’re willing to bleed a little in the short run, because we’re betting on the long play.

The high-risk strategy

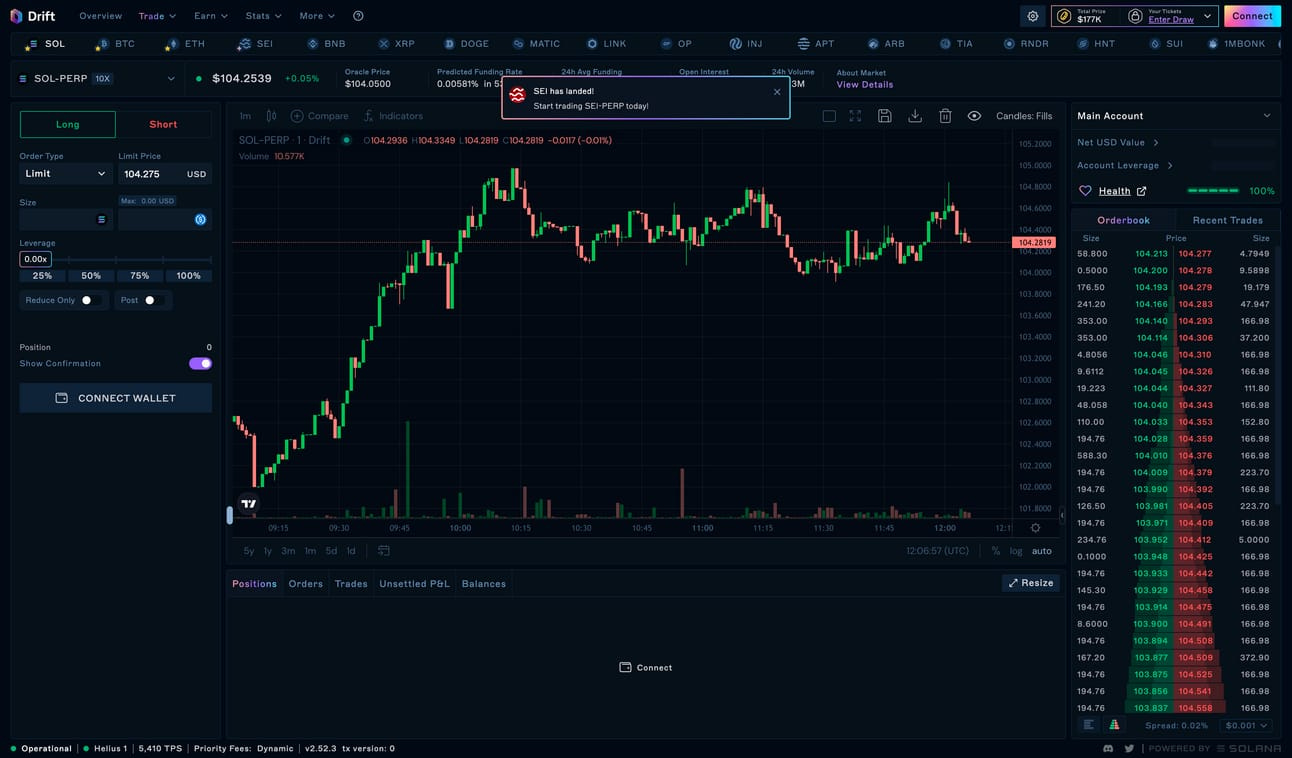

Let’s talk about the high-risk strategy and head over to Drift.

Drift is a perpetual and lending protocol, and it just so happens to be one of my favorite platforms out there. Let’s take that jitoSOL you have, and deposit it here. Simply by depositing it, you can use it as collateral on Drift.

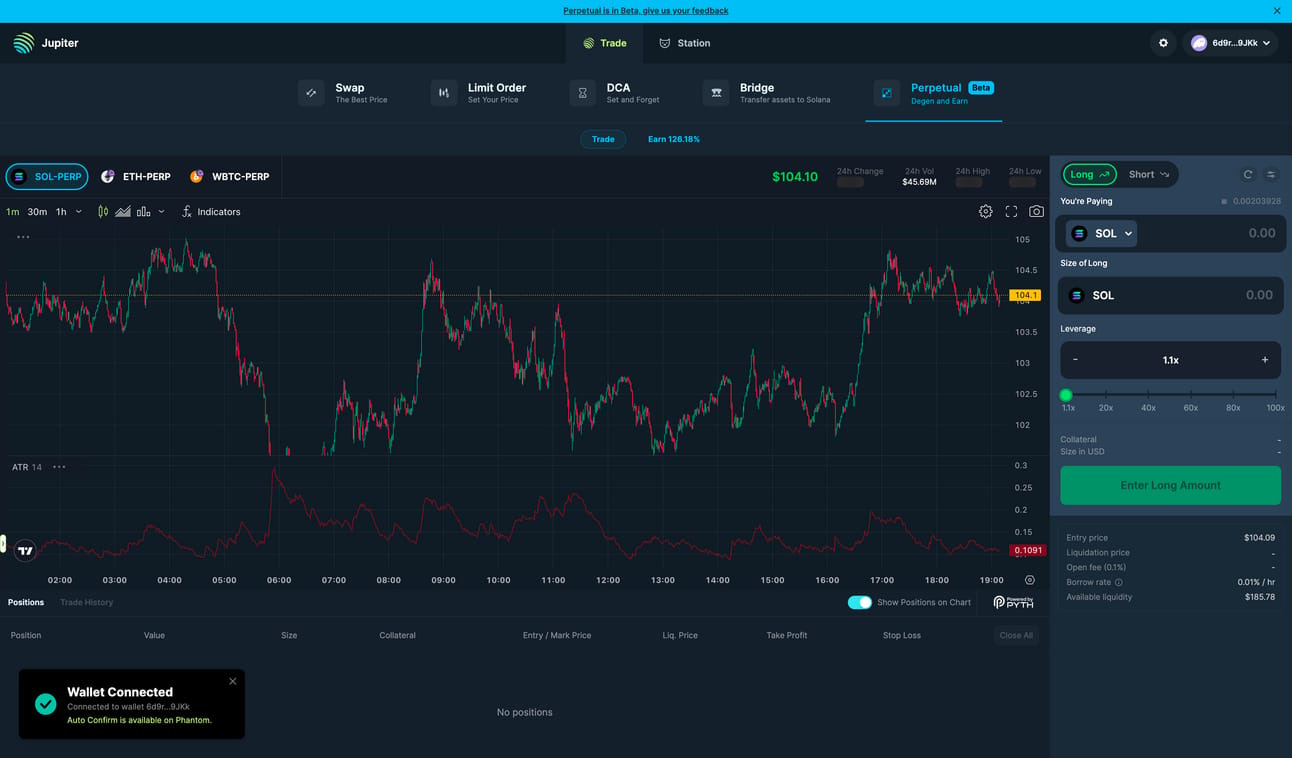

Alternatively, you have the Jupiter protocol.

The first wave of JUP airdrops is closed. There are 3 more waves coming, and here’s what I’m doing to farm for the 2nd wave. I’m using the perp protocol, the swap feature, and the DCA feature, because I’m betting that users of these features stand to gain the most out of the next wave of airdrops.

That’s because the announcement for the first airdrop coincided with the release of these new features. I’m willing to bet that the team will utilize the same approach for the second airdrop, launching it in tandem with a bunch of new features as well, to encourage further farming.

Risk-wise, swaps and DCAing are much less risky compared to perps, so if you want to keep most of your SOL and not degen it away, then you’re going to want to keep it to swaps and DCA.

The perp protocol lets you leverage-trade SOL perps. I love margin trading. It’s basically a way to borrow money against your collateral and multiply your gains—and your losses. The safest bet now is to long SOL when the market is down, obviously, but don’t overleverage and keep your eye on the liquidation price, because you can get your acct wiped out 😭

I was using Drift for long calls on SOL. Every time the market dipped, I would go long. Unfortunately, I got wiped out, so I’m currently looking at Jupiter for quick scalps. This is because the fees can get confusing, and the longer you play, the more you have to pay to keep your position open.

Drift leverage is also fairly modestly capped, whereas Jupiter lets you degen and go like 100x long. Of course, the liquidation risk is greater, which is why I’ll degen and maybe toss 1 or 2 sol at it before going to bed if I feel like a pump is incoming.

Compared to Drift, the two major downsides to Jupiter are…

Lack of liquidity, which encumbers our ability to enter long positions that we desire, instead having to chase liquidity, which puts us in riskier positions.

You can’t place limit orders; only market orders. Basically, you’re forced to buy SOL at the current market price, instead of placing an order so that you can buy it at a specific price (e.g., when SOL hits $105, buy).

As mentioned, with perps, you can win or lose big, so be careful if you don’t know what you’re doing. But if you want to experiment, learn, and have the spirit of FAFO in you, toss a little sol at it and see what happens.

Final thoughts

The airdrop strategy I shared isn’t fixed; you can switch it up and play around with it as much as you want (e.g., go to Kamino Finance first, and then head to MarginFi after).

Wen airdrops? The answer depends on the platform. Jupiter is the next big one. Also dubbed Jupuary by many, it’s planned to drop in the last week of January 2024.

In contrast, Solblaze airdrops BLZE tokens every few weeks. Btw, do NOT miss out on the opportunity to take your BLZE tokens and lend them on Kamino Finance for roughly 3% APY (plus points!).

We’ll have to see about the other platforms, but I imagine they won’t be far behind, and should propel SOL higher. Much higher.

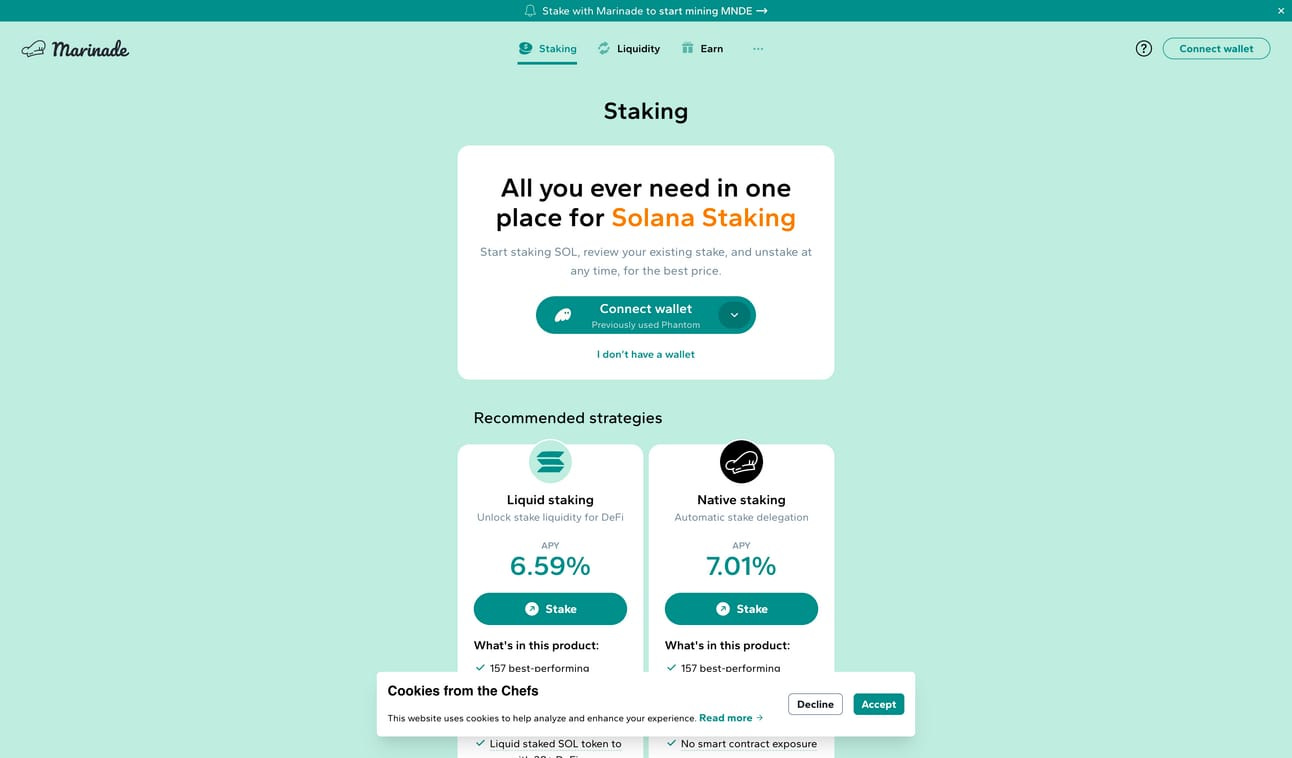

Marinade Finance homepage

Why not use Marinade Finance? Marinade’s rewards are coming to an end—but apparently, they’re being renewed! Still, Solblaze will be the better bet long term imo, since their rewards haven’t ended yet, and their BLZE token, the token that’s airdropped every few weeks, should full-send during the bull. (Watch this prediction come back and bite me in the ass 💨)

Lastly, be sure to always have some liquidity on hand—accessible at any and all times—because you might need it to take out all the funds you’ve got tied up in each protocol at a moment’s notice.

Since we followed steps, it’s a matter of starting with the last step and reverting all our actions when the time comes to pull out. But to do that, we’ll need the minimum amounts required for each protocol, and you may need a little extra here and there for fees and payments and what not.

Ultimately, the bet is that the airdrops will be worth all the trouble and risk. Of course, as always, none of this is financial advice. I am a bozo, after all 🤡

Feel free to leave a comment below my YouTube video if you have any questions. Good luck, and happy farming! 👨🌾